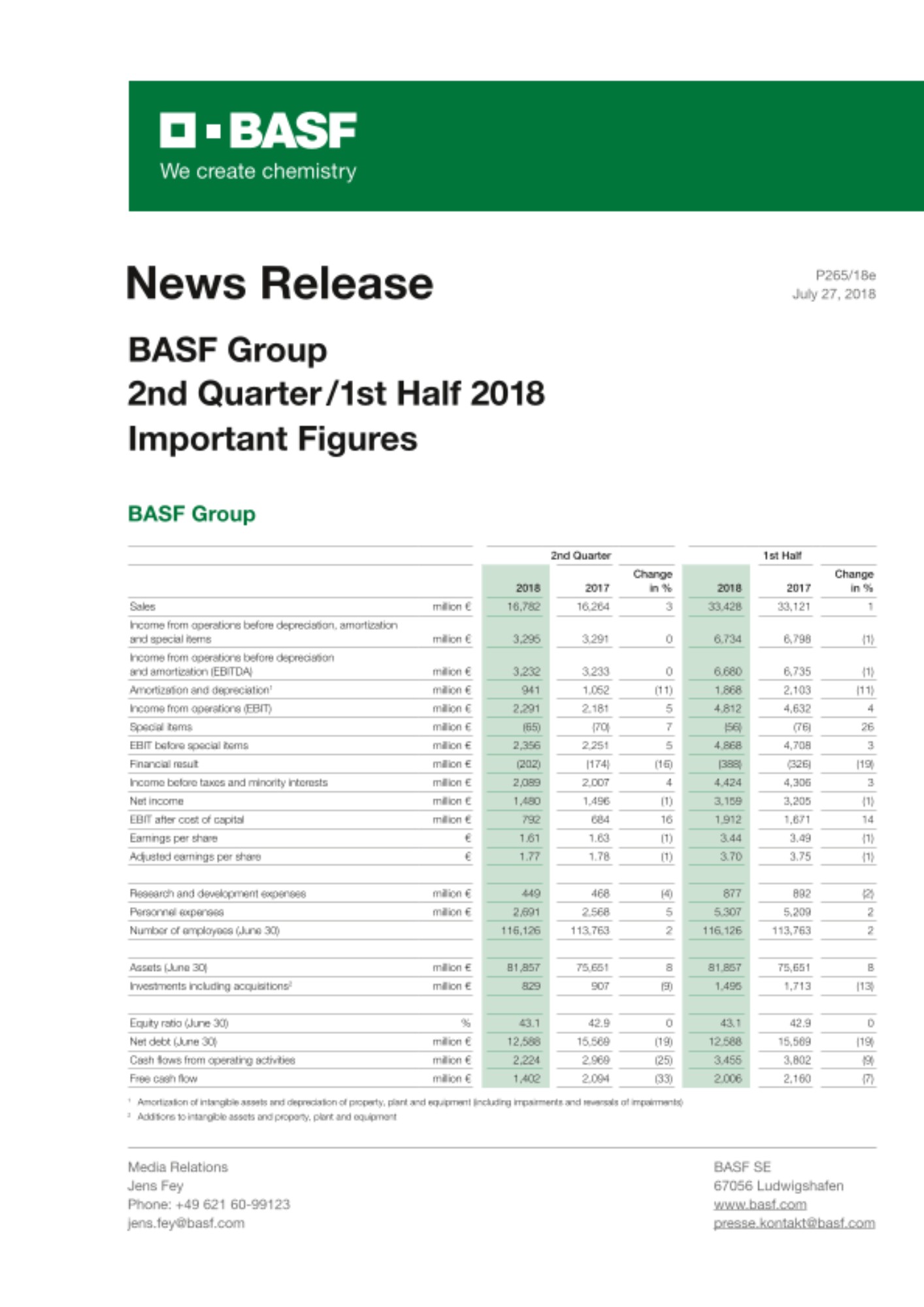

2nd Quarter 2018

- Solid volumes growth in second quarter, prices raised, ongoing negative currency effects

- Sales of €16.8 billion (plus 3%)

- EBIT before special items of €2.4 billion (plus 5%)

Outlook for 2018 confirmed:

- Slight sales growth

- Slight increase in EBIT before special items

In the second quarter of 2018, BASF Group achieved a slight increase in sales and earnings. “Compared with the second quarter of 2017, sales rose by €518 million to €16.8 billion,” said Dr. Martin Brudermüller, Chairman of the Board of Executive Directors of BASF SE. This was driven by higher prices in all segments, particularly in Functional Materials & Solutions and Oil & Gas. In addition, with the exception of Performance Products, all segments achieved volumes growth. This was partially offset by negative currency effects.

BASF increased income from operations (EBIT) before special items by €105 million year on year to €2.4 billion, largely thanks to the significantly improved contribution from the Oil & Gas segment. EBIT before special items rose slightly in the Agricultural Solutions and Performance Products segments but decreased slightly in the Chemicals segment and declined considerably in the Functional Materials & Solutions segment.

Sales also increased compared with the first half of 2017, rising by €307 million to €33.4 billion. This was due to higher sales prices, especially in the Functional Materials & Solutions, Chemicals and Oil & Gas segments, as well as volumes growth in all segments except Performance Products. Negative currency effects, primarily relating to the U.S. dollar, dampened sales in all segments.

BASF increased EBIT before special items in the first half of 2018 by €160 million to €4.9 billion, largely thanks to the significantly improved contribution from the Oil & Gas segment. EBIT before special items rose slightly in the Chemicals segment but decreased slightly in the Performance Products segment and declined considerably in the Functional Materials & Solutions and Agricultural Solutions segments.

New Verbund site planned in the southern Chinese province of Guangdong

Brudermüller used the presentation of the figures for the second quarter of 2018 as an opportunity to discuss BASF’s plans to build an integrated Verbund site in the province of Guangdong in southern China. BASF would be the first foreign company in China with 100% responsibility for building and operating a Verbund site, including a steam cracker. “Once again, BASF is a pioneer here, leading the way,” said Brudermüller.

With a world market share of around 40%, China is already the largest chemical market and dominates the growth of global chemical production. “A company like BASF, which aims to be the world’s leading chemical company, must participate in this major growth market. Furthermore, with a new Verbund site, BASF can play a role in the opening of the chemical industry in China and uniquely position itself in the country,” said Brudermüller.

BASF estimates the investment could reach up to $10 billion by the completion of the project around 2030. The first plants could be completed by 2026 at the latest. “However, we must keep in mind that the signing of the Memorandum of Understanding is only a first step and many more will need to follow. The next step will be completing a pre-feasibility study,” Brudermüller added.

BASF plans to conclude acquisition of Bayer businesses in August

Brudermüller also reported on the status of the transactions agreed with Bayer: “We currently anticipate that the acquisition of these businesses can be concluded in August. And we are looking forward to soon welcoming 4,500 new colleagues with their groundbreaking and innovative fields of work, who will join us at BASF.” The acquisition represents a strategic complement to BASF’s activities in the areas of crop protection, biotechnology and digital farming. Moreover, it marks BASF’s entry into the seeds business.

Outlook for the year 2018

With a view to the current year, Brudermüller said: “Global economic risks increased significantly over the course of the first half of 2018, driven by geopolitical developments and the trade con?icts between the United States and China, as well as between the United States and Europe. We are monitoring these developments and the potential effects on our business very closely.”

At this time, BASF’s assessment of the global economic environment in 2018 remains unchanged, with the exception of the expected oil price. BASF forecasts the following economic conditions (previous forecasts from the BASF Report 2017 in parentheses):

- Growth in gross domestic product: 3.0% (3.0%)

- Growth in industrial production: 3.2% (3.2%)

- Growth in chemical production: 3.4% (3.4%)

- Average euro/dollar exchange rate of $1.20 per euro ($1.20 per euro)

- Average Brent blend oil price for the year of $70 per barrel ($65 per barrel)

BASF confirms the sales and earnings forecasts for the BASF Group contained in the BASF Report 2017 and expects slight sales growth, a slight increase in EBIT before special items and a slight decline in EBIT. Furthermore, BASF expects a significant premium on cost of capital with a considerable decline in EBIT after cost of capital. This forecast does not take into account the intended merger of BASF’s oil and gas activities with the business of DEA Deutsche Erdoel AG and its subsidiaries.

Development of the segments

Sales of €4.1 billion in the Chemicals segment slightly exceeded the €4 billion reported in the prior-year quarter. This was the result of higher prices, especially in the Monomers and Intermediates divisions, as well as volumes growth. By contrast, sales were negatively impacted by currency effects, primarily relating to the U.S. dollar. EBIT before special items declined slightly compared with the second quarter of 2017, but remained high at €1.1 billion. The slight decrease was mainly due to higher fixed costs as a result of plant turnarounds. In the first half of the year, sales in the Chemicals segment grew by 3%, from €8.2 billion to €8.4 billion. EBIT before special items rose by 6% to €2.2 billion.

Sales in the Performance Products segment declined slightly year on year to €3.9 billion (second quarter 2017: €4.1 billion). The main driver was negative currency effects in all divisions, mostly relating to the U.S. dollar. Lower volumes in the Nutrition & Health and Care Chemicals divisions, as well as portfolio effects in the Performance Chemicals and Dispersions & Pigments divisions also had a dampening effect on sales. By contrast, sales were positively impacted by higher sales prices. At €409 million, EBIT before special items increased slightly compared with the prior-year quarter thanks to lower fixed costs and higher margins. Sales in the first half of the year were down by 5%, from €8.4 billion to €7.9 billion. EBIT before special items fell by 4% in the first half of the year to €879 million.

In the Functional Materials & Solutions segment, sales of €5.5 billion grew slightly by 5% compared with the prior-year quarter on the back of higher prices and increased sales volumes. Sales were negatively impacted by currency effects, primarily relating to the U.S. dollar. At €338 million, EBIT before special items was considerably below the figure for the second quarter of 2017, primarily as a result of higher fixed costs and lower margins due to the increase in raw materials prices. In the first half of the year, sales of €10.7 billion were 2% above the level of the prior-year period. EBIT before special items amounted to €671 million, compared with €953 million in the prior-year period.

Sales of €1.5 billion in the Agricultural Solutions segment declined slightly compared with the prior-year quarter due to negative currency effects in all regions. BASF increased sales volumes in South America and Asia in particular, and raised prices slightly. EBIT before special items of €278 million was slightly higher than in the second quarter of 2017. Despite the negative currency effects, a more favorable product mix lifted the average margin. This more than compensated for the slight increase in fixed costs. In the first half of 2018, sales in the Agricultural Solutions segment declined by 4% and amounted to €3.2 billion. EBIT before special items declined by €104 million to €701 million.

In the Oil & Gas segment, sales rose considerably compared with the prior-year quarter to reach nearly €1 billion. This was mainly due to higher prices. Sales were also lifted by increased volumes from Norway following the start of production at new fields as well as stronger trading volumes. The price of a barrel of Brent crude oil averaged $74 in the second quarter of 2018 (second quarter of 2017: $50). Gas prices on the European spot markets were also significantly higher than in the prior-year quarter. Sales were reduced by currency effects. BASF considerably improved EBIT before special items to €391 million (second quarter 2017: €183 million). Oil and gas prices rose. In Norway, BASF recorded both lower depreciation as a result of higher reserves and volumes growth. Net income rose considerably. In the first half of the year, sales rose to €1.9 billion (2017: €1.6 billion) and EBIT before special items increased to €756 million (2017: €353 million).

Sales of €662 million in Other were considerably above the €476 million reported in the second quarter of 2017, mainly as a result of higher sales volumes and prices in raw materials trading. EBIT before special items rose considerably due to lower contributions to provisions and an improved foreign currency result. Compared to the first half of 2017, sales rose by 12% to €1.2 billion and EBIT before special items improved by 13%.

About BASF

At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility. The more than 115,000 employees in the BASF Group work on contributing to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio is organized into five segments: Chemicals, Performance Products, Functional Materials & Solutions, Agricultural Solutions and Oil & Gas. BASF generated sales of €64.5 billion in 2017. BASF shares are traded on the stock exchanges in Frankfurt (BAS), London (BFA) and Zurich (BAS). Further information at www.basf.com.

P-18-264

You can obtain further information from the internet at the following addresses:

| Half-Year Financial Report (from 7:00 a.m. CEST) | |

| basf.com/halfyearfinancialreport | (English) |

| basf.com/halbjahresfinanzbericht | (German) |

| News Release (from 7:00 a.m. CEST) | |

| basf.com/pressrelease | (English) |

| basf.com/pressemitteilungen | (German) |

| Live Transmission (from 9:00 a.m. CEST) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

| Speech (from 9:00 a.m. CEST) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

| Live Transmission – Telephone Conference for analysts and investors (from 11:00 a.m. CEST) |

|

| basf.com/share | (English) |

| basf.com/aktie | (German) |

| Photos | |

| basf.com/pressphotos | (English) |

| basf.com/pressefotos | (German) |

| Current TV footage | |

| tvservice.basf.com/en | (English) |

| tvservice.basf.com | (German) |

Receive the latest news releases from BASF via WhatsApp on your smartphone or tablet. Register for our news service at basf.com/whatsapp-news.

Forward-looking statements and forecasts

This release contains forward-looking statements. These statements are based on current estimates and projections of the Board of Executive Directors and currently available information. Forward-looking statements are not guarantees of the future developments and results outlined therein. These are dependent on a number of factors; they involve various risks and uncertainties; and they are based on assumptions that may not prove to be accurate. BASF does not assume any obligation to update the forward-looking statements contained in this release above and beyond the legal requirements.