Media

BASF’s earnings in tough market environment significantly below strong prior-year quarter

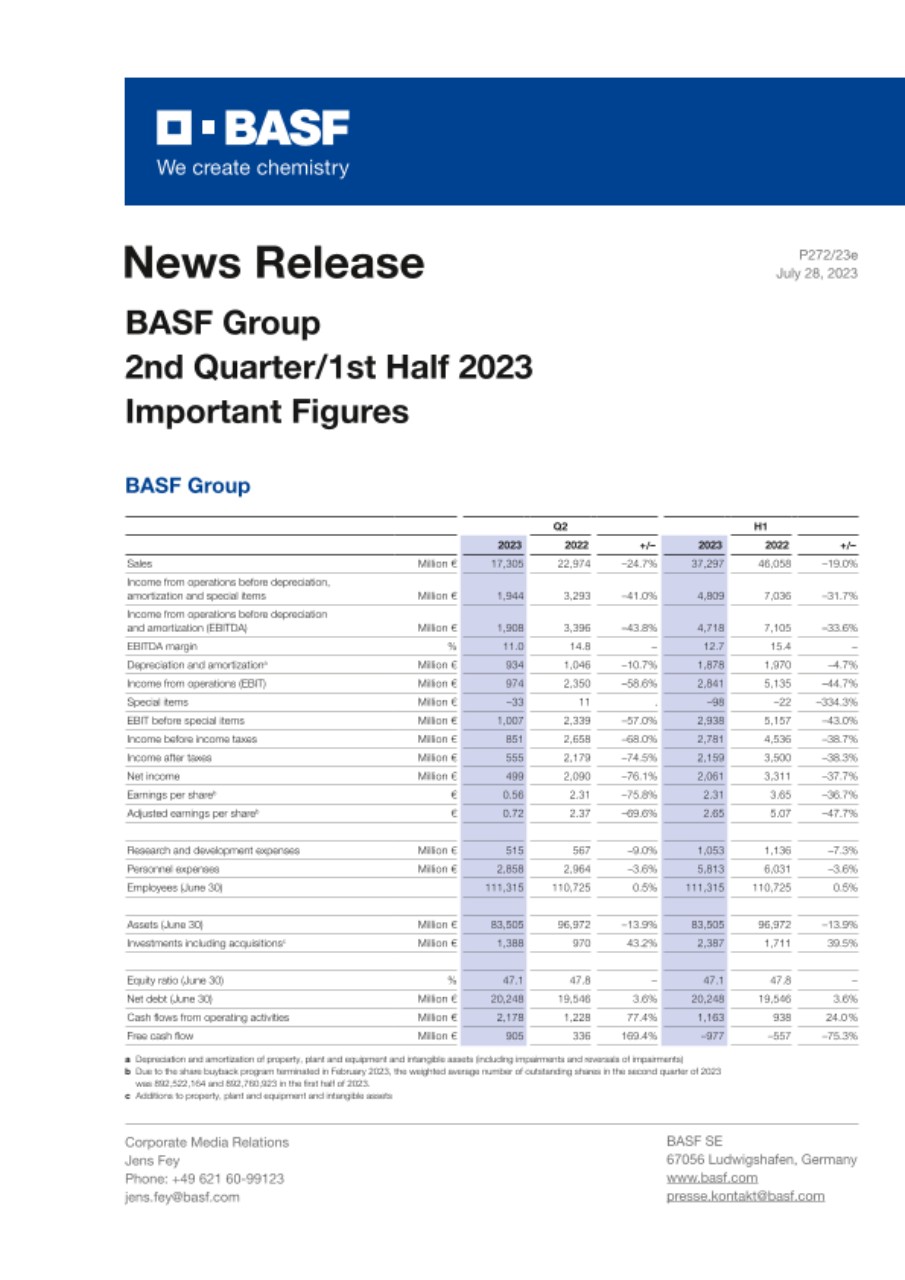

BASF Group 2nd quarter 2023:

- Sales decline by 24.7 percent to €17.3 billion

- EBIT before special items down by €1.3 billion to €1.0 billion

Adjusted outlook 2023:

- Sales of between €73 billion and €76 billion expected

- EBIT before special items of between €4.0 billion and €4.4 billion expected

In a tough market environment, BASF Group sales in the second quarter of 2023 declined by 24.7 percent compared with the prior-year period to €17.3 billion. “We faced low demand from our key customer industries, except for automotive,” said Dr. Martin Brudermüller, Chairman of the Board of Executive Directors of BASF, when presenting the results together with Chief Financial Officer Dr. Dirk Elvermann.

BASF had already adjusted its outlook for 2023 and released preliminary figures on July 12. The decline in sales was mainly driven by lower prices, primarily in the Chemicals, Surface Technologies and Materials segments. The Agricultural Solutions segment was able to implement price increases. Lower sales volumes as a result of weaker demand weighed down the sales performance in all segments. In addition, currency effects dampened sales.

Income from operations (EBIT) before special items of €1.0 billion in the second quarter of 2023 was €1.3 billion below the figure of the prior-year period. Almost all segments contributed to this with significant declines in earnings, in particular the Chemicals and Materials segments. EBIT before special items of the Agricultural Solutions segment decreased slightly. Surface Technologies achieved slight earnings growth. EBIT before special items attributable to Other improved considerably. EBIT decreased by €1.4 billion to €974 million. This figure includes income from integral companies accounted for using the equity method amounting to €22 million (prior-year period: €101 million).

Income from operations before depreciation, amortization and special items (EBITDA before special items) declined by €1.3 billion to €1.9 billion and EBITDA by €1.5 billion to €1.9 billion in the second quarter of 2023. Net income amounted to €499 million, compared with €2.1 billion in the prior-year quarter.

Development of cash flows in the second quarter of 2023

Cash flows from operating activities amounted to around €2.2 billion in the second quarter of 2023, €950 million above the figure of the prior-year period. Payments made for intangible assets and property, plant and equipment increased by €381 million compared with the prior-year quarter to reach €1.3 billion. Free cash flow thus amounted to €905 million in the second quarter of 2023, an improvement of €569 million compared with the second quarter of 2022.

Development of BASF’s segments in the second quarter of 2023

Sales in the Chemicals segment in the second quarter of 2023 decreased by 38.4 percent compared with the prior-year period and amounted to €2.7 billion. Lower raw materials prices, combined with a massive excess of supply and weaker demand, led to lower prices in both operating divisions. Compared with the prior-year quarter, EBIT before special items declined by 76.3 percent to reach €202 million.

At €3.6 billion, sales in the Materials segment were 25.8 percent lower than in the strong prior-year quarter. The decline in sales resulted mainly from significantly lower prices in all regions due to decreased raw materials prices. Sales performance was additionally weighed down in the second quarter of 2023 by a further deterioration in demand. EBIT before special items declined by 60.4 percent compared with the prior-year quarter and amounted to €265 million.

Sales in the Industrial Solutions segment declined by 22.5 percent compared with the prior-year quarter and amounted to €2.1 billion. This development was mainly attributable to a sharp decline in volumes resulting from weaker demand. EBIT before special items fell by 61.6 percent to reach €124 million in the second quarter of 2023.

At €4.2 billion, sales in the Surface Technologies segment were 22.4 percent lower than in the second quarter of 2022. The sales performance of the segment was primarily attributable to significantly lower precious metal prices in the Catalysts division. The segment increased EBIT before special items by 1.5 percent compared with the prior-year quarter to €230 million. A considerable earnings growth in the Coatings division more than compensated for the decline in EBIT before special items in the Catalysts division.

Sales of €1.7 billion in the Nutrition & Care segment were 17.4 percent lower than in the prior-year quarter. The sales performance was attributable to a sharp decline in volumes in all business areas as a result of lower demand. The segment’s EBIT before special items decreased by 84.8 percent to €33 million.

In the Agricultural Solutions segment, sales of €2.2 billion were 9.3 percent below the level of the prior-year quarter. The main reason for this was the decline in volumes due to higher channel inventories in individual core markets as well as lower agricultural commodity prices. At €213 million, EBIT before special items was 4.3 percent below the prior-year quarter, especially due to lower volumes.

Sales in Other declined by 30.0 percent compared with the prior-year quarter and amounted to €799 million. This was primarily due to lower sales in commodity trading. Compared with the prior-year quarter, Other recorded a 64.1 percent improvement in EBIT before special items to minus €60 million. This was mainly attributable to an improved contribution from insurance companies.

Measures to increase competitiveness

BASF is implementing a number of measures to improve competitiveness. As announced at the end of February, the company is executing a cost savings program with a focus on Europe and is adapting its Verbund structures in Ludwigshafen, Germany. “Together with the initiatives that were already underway in our global service units, we will reduce fixed costs by the end of 2026 so that they will then be around €1 billion lower annually,” said Elvermann. By the end of 2023, BASF expects to achieve annual savings of more than €300 million from the cost savings program. “In addition, we continuously and strictly control our fixed costs and avoid discretionary costs wherever possible. We have a sharper focus on cash management to optimize our free cash flow. Over the course of the year, we will continue to reduce our inventory levels,” Elvermann added.

BASF Group outlook 2023

“We do not expect a further weakening in demand at the global level for the second half of 2023, as the inventories of chemical raw materials in most customer industries have already been greatly reduced,” Brudermüller said. “However, we are assuming only a tentative recovery because we expect that global demand for consumer goods will grow slower than previously assumed. Margins are therefore expected to remain under pressure.”

The assumptions for the global economic environment in 2023 were adjusted due to the changed economic developments as follows (previous assumptions from the BASF Report 2022 in parentheses; current growth assumptions are rounded):

- Growth in gross domestic product: 2.0 percent (1.6 percent)

- Growth in industrial production: 1.0 percent (1.8 percent)

- Growth in chemical production: 0.0 percent (2.0 percent)

- Average euro/dollar exchange rate of $1.10 per euro ($1.05 per euro)

- Average annual oil price (Brent crude) of $80 per barrel ($90 per barrel)

Based on the adjusted expectations for further development in the second half of the year, the forecast for the BASF Group for the 2023 business year was adjusted as follows (previous forecast from the BASF Report 2022 in parentheses):

- Sales of between €73 billion and €76 billion

(between €84 billion and €87 billion) - EBIT before special items of between €4.0 billion and €4.4 billion

(between €4.8 billion and €5.4 billion) - Return on capital employed (ROCE) of between 6.5 percent and 7.1 percent

(between 7.2 percent and 8.0 percent) - CO2 emissions of between 17.0 million metric tons and 17.6 million metric tons

(between 18.1 million metric tons and 19.1 million metric tons)

About BASF

At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility. More than 111,000 employees in the BASF Group contribute to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio comprises six segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care and Agricultural Solutions. BASF generated sales of €87.3 billion in 2022. BASF shares are traded on the stock exchange in Frankfurt (BAS) and as American Depositary Receipts (BASFY) in the United States. Further information at www.basf.com.

On July 28, 2023, you can obtain further information from the internet at the following addresses:

| Half-Year Financial Report (from 7.00 a.m. CEST) | |

| basf.com/halfyearfinancialreport | (English) |

| basf.com/halbjahresfinanzbericht | (German) |

| News Release (from 7.00 a.m. CEST) | |

| basf.com/pressrelease | (English) |

| basf.com/pressemitteilungen | (German) |

| Live Transmission (from 8.00 a.m. CEST) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

| Speech (from 8.00 a.m. CEST) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

|

Live Transmission – Telephone Conference for analysts and investors (from 10.00 a.m. CEST) |

|

| basf.com/share/conferencecall | (English) |

| basf.com/aktie/telefonkonferenz | (German) |

| Photos | |

| basf.com/pressphotos | (English) |

| basf.com/pressefotos | (German) |

| Current TV footage | |

| tvservice.basf.com/en | (English) |

| tvservice.basf.com | (German) |

Forward-looking statements and forecasts

This release contains forward-looking statements. These statements are based on current estimates and projections of the Board of Executive Directors and currently available information. Forward-looking statements are not guarantees of the future developments and results outlined therein. These are dependent on a number of factors; they involve various risks and uncertainties; and they are based on assumptions that may not prove to be accurate. BASF does not assume any obligation to update the forward-looking statements contained in this release above and beyond the legal requirements.

P-23-271