Naturally good? Searching for new bio-based raw materials for industry

A car tire made of dandelions? Initial tests have determined that the roots of the Russian dandelion can be a raw material source for natural rubber. These are the findings of a joint project between the tire manufacturer Continental and the Fraunhofer Institute for Molecular Biology and Applied Ecology in Münster, Germany, along with other partners. It will take at least five years, though, before the first dandelion tires hit the streets.

Limited resources and a growing world population require new ways of thinking. One example is the use of bio-based products like wood scraps, dandelions and glucose as complements to crude oil. Worldwide, the bioeconomy is gaining traction. But despite considerable successes, a lot of research and development still needs to be done. When are renewable resources truly good?

Frakta means transport – and that is just what the bag that carries this name is designed to do. Large, robust and simple to clean, the iconic blue shopping bag from the Swedish furniture retailer IKEA can be found in many households. It is used for all kinds of things, including storing bottles and moving house, or as a laundry basket, shopping bag or even a suitcase replacement. For now, this multipurpose bag is made of petroleum-based plastic, partly from virgin polypropylene. However, this will soon change: By 2020, IKEA wants to manufacture all of its plastic products – including carrier bags, children’s toys and storage boxes – from renewable and/or recycled materials. It will not be an easy task. For applications in sensitive areas such as food packaging or children’s toys in particular, health protection requirements mean that today’s recycled plastics are not an option. Alternatives are needed. “Here, we are trying to replace oil-based plastics with those made from renewable raw materials. This could mean 100 percent bio-based polymers such as polylactide or else combinations of a variety of biobased materials. In some cases, mixtures with oil-based plastics are also a possible first step,” explains Puneet Trehan, Material Innovation and Development Leader at IKEA. The initial target, he says, is a bio-based proportion of 40 to 60 percent.

Complements to crude oil

Bio instead of petro: IKEA is not the only company committed to biobased plastics. Around 100 years after the invention and marketing of the first entirely synthetic plastic Bakelite®, which was soon followed by thousands of others, scientists and producers are now turning their research focus in a new direction. The products of tomorrow should be high quality but made from renewable resources, plants, organic waste or microorganisms. Toy manufacturer LEGO, for example, has said it wants to produce its building bricks from plastic made of alternative materials as of 2030. To do so, in 2015 the company announced it was investing the equivalent of around €135 million to found its own Sustainable Materials Center. In 2009, the Coca-Cola Company launched its PlantBottleTM technology and soon afterwards it licensed the technology to other major companies such as ketchup producer H.J. Heinz and Ford Motor Company. The polyethylene terephthalate (PET) bottle was initially made up of 30 percent plant-based material. Coca-Cola’s goal is to produce the PlantBottle using only renewable resources. In the next decade, this should be the case for all PET plastic bottles, which represent around 60 percent of all of Coca-Cola’s packaging.

One solution that enables plastic bottles to be made from 100 percent renewable raw materials is offered by the company Synvina. This recently established joint venture between BASF and Dutch company Avantium produces the chemical building block furandicarboxylic acid (FDCA) from fructose. FDCA can be used to make polyethylenefuranoate (PEF), which can be manufactured into beverage bottles and food packaging. PEF bottles have some unique features: Not only are they 100 percent bio-based, compared to bottles made of PET they offer improved barrier properties for gases like carbon dioxide and oxygen, leading to a longer shelf life for the packaged beverages. The automotive industry is also aiming to go back to the roots: In its early days, the car industry worked with biomaterials – as demonstrated by a car developed by Henry Ford in the 1930s with a body made of hemp fibers. But after the passage of the Marihuana Tax Act in 1937 in the United States, the pressure on Ford grew too great and development was stopped. Today there is renewed interest in the idea of lowering a car’s carbon emissions by reducing weight through the use of natural materials such as hemp, sisal, kenaf and flax. Increasingly, components are being made from the relatively less expensive natural-fiber plastics instead of the lightweight building materials carbon or glass fiber.

A traditional material creates new possibilities: Liquid wood, largely made up of the polymer lignin, can be shaped into any form using injection molding. It can be used to make enclosures for headphones like these from the firm Audioquest, or casing for speakers and mobile phones. Around 50 million metric tons of lignin are generated as waste from paper production each year.

Lowering carbon emissions

The fossil-based economy is increasingly reaching its limits. Climate change and the associated need to reduce greenhouse gases mean it is time for a rethink. “Biobased products are now the only alternative. Without the bioeconomy, the G7 countries’ long-term goal of eliminating carbon dioxide emissions is probably not achievable,” says Waldemar Kütt, PhD, head of the unit Bio-Based Products and Processes at the European Commission’s Directorate-General for Research and Innovation. The reason for this is that plants absorb carbon dioxide from the air through photosynthesis. “When we use this carbon obtained from plant or microbial biomass in manufacturing our products, we are removing CO2 from the environment, in harmony with the natural biological carbon cycle. This is not the case with oil, which has been created over millions of years and offers no advantages in CO2 reduction,” explains Ramani Narayan, Professor of Chemical Engineering and Material Sciences at Michigan State University, USA. Oil will not be replaced completely, but even partial substitution is a positive step forward to reducing our carbon footprint. “If just 20 percent of the carbon in the 37.5 million or so metric tons of PET used in making bottles worldwide were to be replaced by bio-based carbon, this would absorb 17.2 million metric tons of CO2 from the environment. That would be equivalent to about 40 million barrels of oil savings,” Narayan says.

Growing production capacity for bio-based products

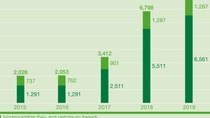

There are two phrases that consumers come across time and again when it comes to bioplastic: biobased and biodegradable. Biobased plastic is made from renewable raw materials but is not necessarily biodegradable. It can even be just as long-lasting as conventional plastic. On the other hand, plastic made from crude oil or natural gas can be biodegradable (see box). “We are seeing growing demand for bio-based products which we are addressing with new technologies and innovations. At the same time, we are expanding our portfolio of biodegradable materials,” says Carsten Sieden, PhD, head of BASF’s white biotechnology research unit. For now, bioplastics still represent a small slice of the market. They make up less than 1 percent of the 300 million metric tons of plastics produced worldwide each year. But, according to market data from the industry association European Bioplastics, this figure should rise sharply in the coming years. The global production capacity of around 2 million metric tons (2015) should nearly quadruple by 2019 to about 7.8 million metric tons. The lion’s share (around 80 percent) consists of bioplastics which are made from biobased raw materials but are not biodegradable or compostable.

Not every bioplastic is biodegradable

Biodegradable plastics are used in organic waste bags and in agricultural mulch film, among other things. BASF’s compostable plastic ecovio®, for example, proves its advantages in the Chinese agriculture sector. In China, the conventional technique of using mulch film made from non-biodegradable polyethylene plastic is becoming a serious environmental problem. The film helps plants to grow by keeping heat and moisture in the soil, but all of the film is left behind in small, thin strips on the fields. When plowed under, the plastic pieces hinder root growth and thus lower future yields. Farmers who have switched over to using biodegradable mulch film made from ecovio have been able to increase their yields again. This has also been proven by large-scale experiments that BASF has been carrying out for years in cooperation with local partners and organizations. For example, in one test field for potatoes in the province of Guangdong, yield was increased by 18 percent, which also reduced harvest costs by 11 percent.

Political strategies

Given the limited resources, how can a growing population be provided with enough daily essentials such as food and energy? Policymakers and industry are looking to the bioeconomy to provide answers to a key question of the 21st century. All of the G7 countries have launched related initiatives and some have introduced very decisive strategies. The U.S. government, for example, published the National Bioeconomy Blueprint in 2012, which declared bioscience research and commercialization as a “major driver” of American economic growth. That same year, Japan passed its Biomass Industrialization Strategy, an action plan which sets out seven initiatives with clear timelines and targets. Japan’s policies aim to advance the development of new biorefinery technologies as well as biological resources such as microalgae. The medium-term focus is on new industrial technologies, while the short-term priority is securing bio-based energy supplies.

Last but not least, the European Union is also an important supranational player in this paradigm shift. Nearly five years ago, it presented its Bioeconomy Strategy and policy plan for a European bioeconomy. Two years later, the European Commission launched the Bio-Based Industries Joint Undertaking as a central investment initiative in 2014. Around 70 companies from the agriculture, forestry, chemical and energy sectors are involved, as are technology suppliers as industry partners. Altogether, this initiative will invest around €3.7 billion by 2020 in the commercialization of new bio-based products and processes. It is not only the leading industrial nations that are planning a partial shift. A lesser known fact is that today around 45 countries have already developed very diverse strategies for a partial transition to a system with renewable resources and bio-based production processes. For example, Uganda is fostering the use of renewable energies, biotechnology and biomass, while in Malaysia the focus is on switching to bio-based products.

Microbiologist and fashion designer Anke Domaske creates clothing made of milk that is no longer suitable for consumption. Her QMilk fibers are based on the powdery milk protein casein. This biofiber is gentle to skin, completely compostable – and theoretically even edible.

The question of sustainability

Nevertheless, the move towards a bioeconomy is also the subject of critical discussions. Topics such as “food versus fuel,” land use and the corresponding resource inputs for cultivation, and fair working conditions play a central role in the current debate about renewable resources. At present, there are signs that second-generation biomass – made up of non-edible raw materials – is becoming increasingly important. Although this does not mean that canola (rapeseed oil), corn, and the like, as the first generation, have been superseded as a result. “Bioeconomy and bio-based industries have the potential to provide sufficient food, feed, fiber and other materials to meet our needs, if they are developed in the right way,” says Joanna Dupont-Inglis, Director of Industrial Biotechnology at EuropaBio. “However, there will be no ‘one size fits all’ answer because the bioeconomy is incredibly diverse and therefore different feedstocks make sense in different regions for different applications. In addition, we are sure to see new solutions for both minimizing waste and using what is unavoidable more.” Nylon from wood, tires from dandelions, lubricants from thistles – second-generation biomass is predominately made up of non-edible plants, organic waste and residues. According to the United Nations, around 5 billion metric tons of biomass are created annually in the form of agricultural residues. As these are not suitable for food, they can be used as raw materials.

Plant-powered engines

The price must be right

Theoretically, the bioeconomy has great potential: a boost to innovation from a key technology, better performance, new jobs and lower carbon dioxide emissions. Nevertheless, it should not be overestimated. “The bioeconomy is not a silver bullet or the answer to all of our problems, but it can help us tackle some of the biggest societal and environmental challenges that we face,” Dupont-Inglis says, adding: “All 100,000 chemicals that are currently in use can, in theory, be made from renewable carbon sources rather than from fossil carbon. However, of course we need to consider all three pillars of sustainability in developing the bioeconomy of the future, which means weighing up the environmental, societal and economic benefits in each case.” BASF researcher Sieden adds: “One lever to advance the bioeconomy is sufficient volumes at competitive prices. But most importantly, a strong biobased industry is a major opportunity for innovations. We want to leverage this potential in our research network.”

More and more customers are asking for bio-based products. “This is a great opportunity for us to expand our raw material base. But that won’t be possible from one day to the next,” explains Sieden. It took over half a decade of research and development work in order to make bio-based succinic acid – produced from the bacterium Basfia succiniciproducens – into a commercial product. The acid is an important component for biodegradable plastics, coatings and polyurethanes, which can be used to manufacture mattresses, flooring and automotive seating. Succinity, the joint venture between BASF and the Dutch company Corbion, has been operating a plant in Montmélo, Spain, since 2014 that has an annual capacity of 10,000 metric tons of bio-based succinic acid for the world market. The issue of sufficient volumes is also a key challenge for IKEA executive Puneet Trehan. However, he sees significant progress for his sector even at the cost stage. “Our experience shows that if the value chain is organized correctly in a partnership, the costs will certainly be competitive,” he says. In his view, one thing is important above all else: “You need partners who are signed up to the same goal.” Business as usual is not an option in the world of bioeconomy. “‘Industrial evolution’ would perhaps be fitting for the transition which is currently under way,” says Joanna Dupont‑Inglis. “Producing renewable and resource-efficient bio-based solutions will involve previously unseen levels of collaboration across a diverse range of industries and sectors.”

Renewable raw materials in use

It doesn’t always have to be crude oil. We show how products made entirely or partly from renewable raw materials have already established their place in our everyday lives – or will in the future.