Media

First quarter 2018 / Annual Shareholders’ Meeting

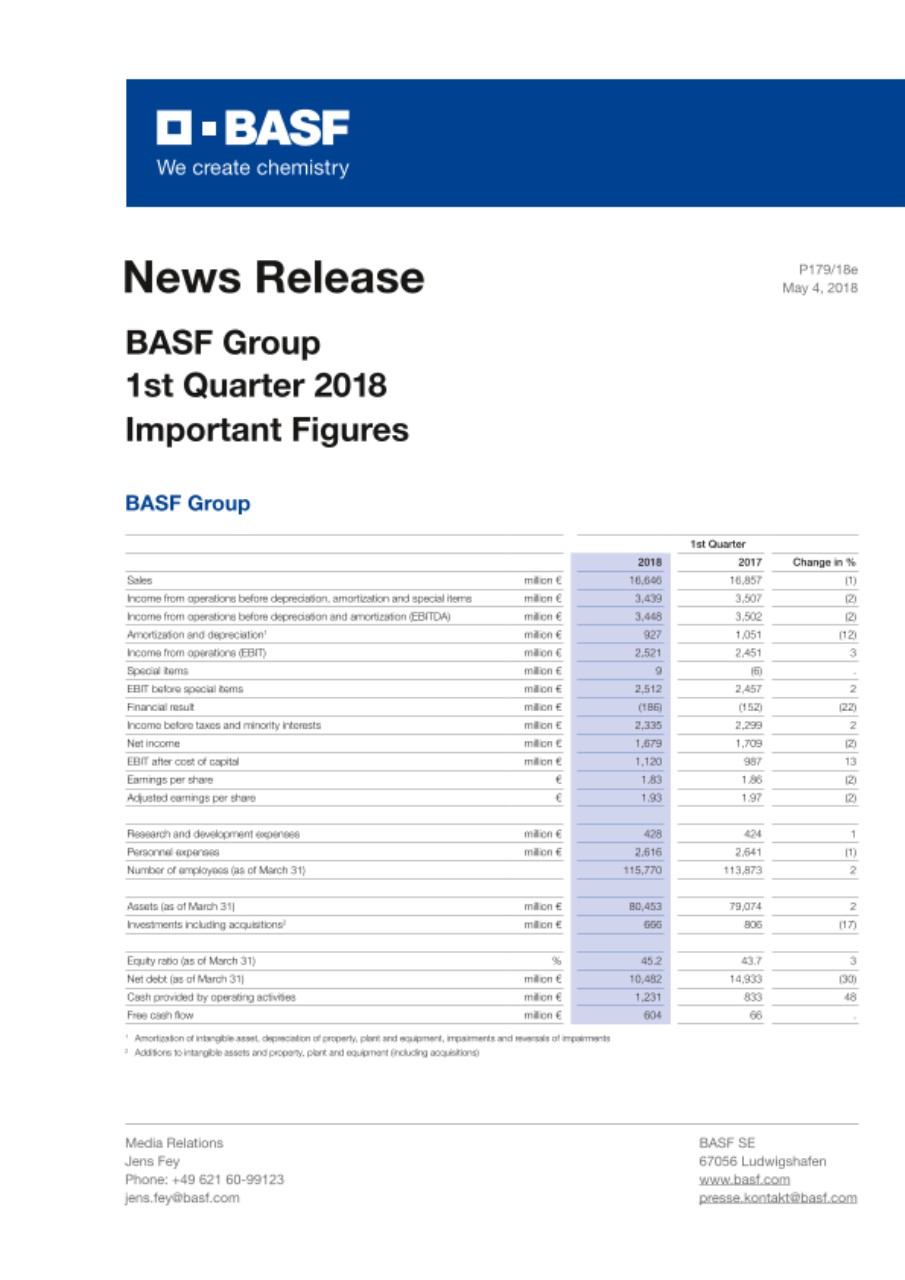

1st Quarter 2018:

- Sales of €16.6 billion (minus 1%)

- EBIT before special items of €2.5 billion (plus 2%)

- EBIT of €2.5 billion (plus 3%)

- Cash provided by operating activities of €1.2 billion (plus 48%);

free cash flow of €604 million (plus €538 million)

Outlook for 2018:

- Slight sales growth, mainly resulting from higher sales volumes

- EBIT before special items expected to be slightly above 2017 level

“We were pleased with the development in the first quarter of 2018, we have had a good start to the year,” said Dr. Kurt Bock, Chairman of the Board of Executive Directors of BASF SE, commenting on the year-on-year rise in first-quarter earnings during the BASF Annual Shareholders’ Meeting at Congress Center Rosengarten in Mannheim, Germany. At €2.5 billion, income from operations (EBIT) before special items in the first quarter of 2018 was €55 million higher than in the same period of the previous year. This was mainly due to the significant improvement in earnings in the Chemicals and Oil & Gas segments. Sales declined slightly by €211 million compared with the first quarter of 2017 to €16.6 billion. This was attributable to significantly negative currency effects (‑8%) in all segments. Higher sales prices (+5%), especially in the Functional Materials & Solutions and Chemicals segments, and increased volumes (+2%) had a positive impact on sales. All segments except Performance Products recorded volumes growth.

EBIT rose by €70 million as against the first quarter of 2017 to €2.5 billion. Income before taxes and minority interests rose by €36 million to €2.3 billion. The tax rate increased from 22.9% to 24.7%, mainly as a result of higher earnings contributions from companies in countries with a high tax rate, such as Norway. Net income declined by €30 million to €1.7 billion. Earnings per share were €1.83 in the first quarter of 2018, compared with €1.86 in the prior-year period. Earnings per share adjusted for special items and amortization of intangible assets amounted to €1.93 (first quarter of 2017: €1.97).

Cash flows from operating activities in the first quarter of 2018 amounted to €1.2 billion, €398 million above the figure for the prior-year quarter. This was primarily attributable to the lower level of cash tied up in net working capital, largely from receivables. The main offsetting factors were lower amortization and depreciation of intangible assets and property, plant and equipment. Free cash flow rose from €66 million in the prior-year quarter to €604 million. Both the higher cash flows from operating activities and the lower payments made for property, plant and equipment and intangible assets contributed to the increase.

Dr. Kurt Bock confirmed the outlook for the full year 2018, speaking to shareholders at the BASF Annual Shareholders’ Meeting. Bock is retiring from BASF SE’s Board of Executive Directors at the end of the Annual Shareholders’ Meeting. He will be succeeded as Chairman by Dr. Martin Brudermüller, who has been a member of the Board of Executive Directors of BASF SE since 2006, Vice Chairman since 2011 and Chief Technology Officer since 2015. Upon the conclusion of the Annual Shareholders’ Meeting, Chief Financial Officer Dr. Hans-Ulrich Engel will assume the role of Vice Chairman.

Proposed dividend of €3.10 per share

The Board of Executive Directors and the Supervisory Board have proposed to the Annual Shareholders’ Meeting that the dividend be raised by €0.10 to €3.10 per share. The BASF share thus once more offers an attractive dividend yield of 3.4% based on the 2017 year-end share price of €91.74. Following the adoption of the relevant resolution by the Annual Shareholders’ Meeting, a total of €2.8 billion will be paid out to shareholders of BASF SE on May 9. “Our dividend policy stands for reliability and sustainability. This is a promise we keep,” Bock told the shareholders at Rosengarten in Mannheim.

Outlook for 2018 confirmed

BASF’s expectations for the global economic environment in 2018 remain unchanged:

- Growth in gross domestic product: +3.0%

- Growth in industrial production: +3.2%

- Growth in chemical production: +3.4%

- An average euro/dollar exchange rate of $1.20 per euro

- An average oil price (Brent) for the year of $65 per barrel

BASF confirmed the sales and earnings forecasts for BASF Group contained in its 2017 annual report, which states the company aims to slightly increase sales and EBIT before special items and forecasts a slight decline in EBIT. “We want to slightly increase EBIT before special items in 2018,” said Bock. “This is ambitious because 2017 was a very good year for BASF.”

Business development in the segments in first quarter 2018

At €4.3 billion, sales in the Chemicals segment slightly exceeded the figure for the prior-year period (first quarter 2017: €4.1 billion). This was largely due to higher prices in the Monomers and Intermediates divisions as well as sales volumes growth in the Petrochemicals division. Sales were however significantly weighed down by currency effects, mainly relating to the U.S. dollar. BASF considerably increased EBIT before special items to more than €1.1 billion, up by 18% compared with the first quarter of 2017, as a result of higher margins and volumes.

Sales in the Performance Products segment declined considerably compared with the prior-year quarter and amounted to around €4 billion (first quarter 2017: around €4.3 billion). This was primarily attributable to negative currency effects in all divisions, mainly relating to the U.S. dollar. Sales were also reduced by lower volumes in the Nutrition & Health and Care Chemicals divisions as well as portfolio effects. BASF was able to increase sales prices and, adjusted for currency effects, increased the average margin compared with the prior-year quarter. EBIT before special items nevertheless declined slightly by €45 million year on year to €470 million, largely as a result of negative currency effects.

Sales of €5.1 billion in the Functional Materials & Solutions segment were slightly lower than in the prior-year period (first quarter 2017: €5.2 billion). This was mainly due to negative currency effects, which could not be completely offset by higher prices and slight volumes growth. EBIT before special items declined considerably to €333 million as a result of lower margins and higher fixed costs (first quarter 2017: €531 million).

Sales in the Agricultural Solutions segment amounted to €1.7 billion, down by 7% compared with the first quarter of 2017. This was primarily attributable to negative currency effects in all regions. Sales were also reduced by slightly lower prices in North America in particular. By contrast, sales volumes increased. Business development in the Northern Hemisphere was dampened by the long and cold winter. At €423 million, EBIT before special items was considerably lower than in the prior-year period (first quarter 2017: €533 million). This was mainly attributable to negative currency effects and higher fixed costs in areas such as production and research.

BASF recorded considerable year-on-year sales growth in the Oil & Gas segment. The 14% increase in sales to €945 million was mainly due to price increases, as well as higher volumes from Norway and stronger trading volumes. The price of a barrel of Brent crude oil averaged $67 in the first quarter of 2018 (prior-year quarter: $54). Gas prices on the European spot markets also rose significantly compared with the prior-year quarter. This was partially offset by currency effects, primarily relating to the U.S. dollar. EBIT before special items also improved considerably, rising by €195 million versus the previous first quarter to reach €365 million.

Sales in Other were down by 9% on the prior-year quarter due, among other things, to lower sales of technical materials and workshop and engineering services. EBIT before special items increased considerably, primarily as a result of valuation effects from the long-term incentive program.

Receive the latest news releases from BASF via WhatsApp on your smartphone or tablet. Register for our news service at basf.com/whatsapp-news.

About BASF

At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility. The more than 115,000 employees in the BASF Group work on contributing to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio is organized into five segments: Chemicals, Performance Products, Functional Materials & Solutions, Agricultural Solutions and Oil & Gas. BASF generated sales of €64.5 billion in 2017. BASF shares are traded on the stock exchanges in Frankfurt (BAS), London (BFA) and Zurich (BAS). Further information at www.basf.com.

On May 4, 2018, you can obtain further information online at the following addresses:

| Quarterly Statement (from 7:00 a.m. CEST) | |

| basf.com/quartalsmitteilung | (German) |

| basf.com/quarterlystatement | (English) |

| News release (from 7:00 a.m. CEST) | |

| basf.com/pressemitteilungen | (German) |

| basf.com/pressrelease | (English) |

| Live Transmission – Telephone Conference on 1st Quarter 2018 for Analysts and Investors (from 08:30 a.m. CEST) | |

| basf.com/aktie | (German) |

| basf.com/share | (English) |

| Live Transmission – Speech Dr. Kurt Bock (from 10:00 a.m. CEST) | |

| basf.com/hauptversammlung | (German) |

| basf.com/shareholdermeeting | (English) |

| Photos | |

| basf.com/pressefotos | (German) |

| basf.com/pressphotos | (English) |

| Current TV footage | |

| tvservice.basf.com | (German) |

| tvservice.basf.com/en | (English) |

Forward-looking statements and forecasts

This release contains forward-looking statements. These statements are based on current estimates and projections of the Board of Executive Directors and currently available information. Forward-looking statements are not guarantees of the future developments and results outlined therein. These are dependent on a number of factors; they involve various risks and uncertainties; and they are based on assumptions that may not prove to be accurate. BASF does not assume any obligation to update the forward-looking statements contained in this release above and beyond the legal requirements.

P-18-185