Media

BASF posts slight increase in 2018 sales and decline in earnings due mainly to lower contributions from Chemicals

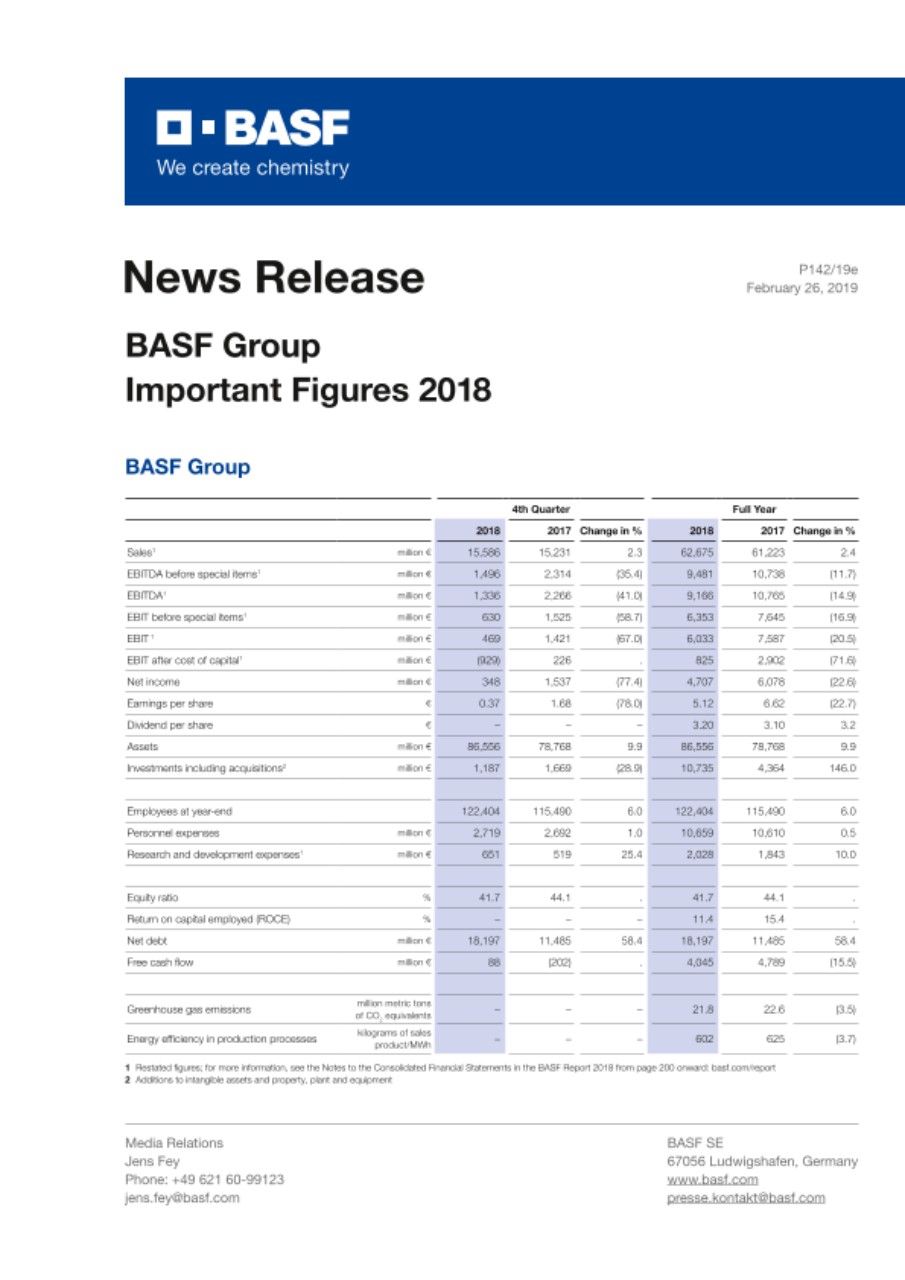

- Sales of €62.7 billion (plus 2%)

- EBIT before special items of €6.4 billion (minus 17%)

- Cash flows from operating activities of €7.9 billion (minus 10%)

Free cash flow €4 billion - Proposed dividend of €3.20 for 2018 financial year (2017: €3.10)

Outlook 2019:

- Slight sales growth expected, mainly from higher sales volumes and portfolio effects

- EBIT before special items slightly above 2018 level anticipated

BASF generated sales of €62.7 billion last year. This represents an increase of 2% compared with the previous year. Income from operations (EBIT) before special items declined to €6.4 billion, compared with €7.6 billion in the previous year. This was mainly attributable to the Chemicals segment, which accounted for around two-thirds of the total decline in earnings. Isocyanate margins fell sharply in the second half of the year. Furthermore, cracker margins were lower than expected in all regions in 2018.

Overall, 2018 was a year characterized by difficult global economic and geopolitical developments and trade conflicts. In the second half of the year, BASF felt an economic slowdown in key markets, especially in the automotive industry, BASF’s largest customer sector. In particular, demand from Chinese customers declined significantly. The trade conflict between the United States and China contributed to this. Around the world, uncertainties grew. Many market participants therefore acted very cautiously.

“We are tackling these challenges. With our new corporate strategy, we will use 2019 as a transitional year to emerge even stronger. This year, we are adapting our structures and processes, and focusing our organization clearly on the needs of our customers,” said BASF’s Chairman of the Board of Executive Directors, Dr. Martin Brudermüller, who presented the 2018 financial figures together with Chief Financial Officer Dr. Hans-Ulrich Engel.

BASF implemented price increases in all segments and divisions in 2018. Volumes rose slightly compared with the previous year: Higher volumes in the Functional Materials & Solutions and Agricultural Solutions segments were partially offset by lower volumes in the Performance Products and Chemicals segments. The main reason for the lower volumes in the Performance Products segment was the outage at the citral plant in Ludwigshafen, which started production again in the second quarter. Sales volumes in the Chemicals segment were negatively influenced by the low water levels on the Rhine River. Currency effects were minus 4% overall, while portfolio effects were plus 1%.

Lower earnings in the Functional Materials & Solutions, Agricultural Solutions and Performance Products segments also contributed to the decline in EBIT before special items. In the Agricultural Solutions segment, negative currency effects in all regions dampened earnings. In addition, there was a strongly negative contribution from the businesses acquired from Bayer, which BASF only took over in August. This timing was a disadvantage because of the seasonality of the seeds business, which primarily generates income in the first half of the year. Moreover, there were costs for integrating the acquired activities.

As well, the unusually long period of low water levels on the Rhine River posed a challenge for BASF. At the Ludwigshafen site, for much of the third and fourth quarter, it was nearly impossible to receive deliveries of raw materials via ship. Consequently, BASF was forced to reduce plant capacity utilization rates in Ludwigshafen. This lowered 2018 earnings by around €250 million.

Special items amounted to minus €320 million, primarily due to acquisitions. This compares with minus €58 million in the previous year. EBIT declined by 20% to €6 billion. At €9.5 billion, EBITDA before special items was 12% below the prior-year level. EBITDA amounted to €9.2 billion, compared with €10.8 billion in 2017.

Earnings per share fell from €6.62 to €5.12 in 2018. Adjusted for special items and amortization of intangible assets, earnings per share amounted to €5.87, down by €0.57 from the previous year.

BASF Group earnings development in the fourth quarter 2018

BASF Group’s sales rose by 2% in the fourth quarter of 2018 to €15.6 billion. Supported by the segments Performance Products, Functional Materials & Solutions and Agricultural Solutions, prices could be raised by 2%. Volumes declined by 3%. This was primarily attributable to the prolonged low water levels on the Rhine River, which severely limited shipments of key raw materials to the Ludwigshafen site and thus forced us to reduce capacity utilization. Portfolio effects amounted to plus 3% due to the acquisition of Bayer businesses in the Agricultural Solutions segment.

EBIT before special items in the fourth quarter was €630 million, down 59% on the prior-year figure. This decline was due to significantly lower earnings in the Chemicals and Agricultural Solutions segments. In the Chemicals segment, the main reason for this was lower margins in the isocyanate and cracker business. Fourth-quarter earnings development in the Agricultural Solutions segment was hampered by acquisition-related expenses. BASF was able to improve earnings in the Performance Products and Functional Materials & Solutions segments. The supply bottlenecks resulting from the low water levels on the Rhine River had a negative impact of around €200 million on earnings in the fourth quarter.

BASF Group cash flows in full year 2018

Cash flows from operating activities declined from €8.8 billion to €7.9 billion. This was mainly due to the decrease in net income. In 2018, the change in net working capital reduced cash flows by €530 million; this compared with minus €1.2 billion in 2017. Cash used in investing activities increased from €4 billion to €11.8 billion. In 2018, net payments for acquisitions and divestitures amounted to €7.3 billion, mainly relating to the acquisition of businesses and assets from Bayer. Payments made for property, plant and equipment and intangible assets declined by €102 million to €3.9 billion. At €4 billion, free cash flow was once again strong, but €744 million lower than the 2017 level due to the decrease in cash flows from operating activities.

Proposed dividend of €3.20

“BASF wants to increase its dividend even in challenging times. That is why we will propose to the Annual Shareholders’ Meeting a dividend of €3.20 per share, €0.10 higher than in the previous year. The BASF share thus offers a very attractive dividend yield of 5.3% based on the 2018 year-end share price,” said Brudermüller.

Implementation of BASF’s strategy

BASF has further developed its strategy, which the company is systematically implementing with numerous measures. As a first step, as of January 1, BASF changed the organizational allocation of around 14,000 employees who previously worked in central units. This transfer into the operating divisions went very smoothly.

“The entire process will be completed by the end of the third quarter 2019 and around 20,000 colleagues will then be working closer to our customers. This will enable us to better recognize our customers’ needs, develop ideas and implement them faster,” said Brudermüller. The changes to the organization affect areas such as research and development, engineering, supply chain, purchasing, human resources, information services and environment, health and safety.

BASF also changed its reporting structure and has six segments instead of four as of January 1, 2019: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care and Agricultural Solutions. “This will make our reporting more transparent and easier to compare with that of our competitors,” said the BASF Chairman.

BASF has undertaken numerous measures to further develop its portfolio. For example, it has completed the transfer of BASF’s business with paper and water chemicals to Solenis. The combined business, in which BASF has a 49% stake, has been operating under the name Solenis since February 1, 2019. In 2017, it reported pro forma sales of around €2.4 billion and had approximately 5,200 employees. Today the combined business offers an expanded product portfolio for customers in the paper and water treatment industries.

On January 18, 2019, the European Commission gave BASF conditional clearance to acquire Solvay’s polyamide business. To address the European Commission’s competition concerns, BASF must divest parts of the original transaction scope to a third-party buyer, namely manufacturing assets and innovation capabilities of Solvay’s polyamide business in Europe. Brudermüller commented: “With this acquisition, BASF can still achieve its strategic goals and considerably strengthen the business with polyamide 6.6.”

BASF and LetterOne are now expecting the required regulatory approvals for the merger of their respective oil and gas businesses in a joint venture. The two companies signed a merger agreement at the end of September 2018. Completion of the transaction is planned for the first half of 2019. The preparatory measures for the integration are proceeding according to plan. BASF expects that the initial public offering (IPO) will take place in the second half of 2020 at the earliest.

As part of BASF’s active portfolio management, the company continuously examines whether businesses can even better fulfill their potential in a different constellation, for example, in a joint venture or outside of BASF. In this context, BASF announced in October 2018 that it was evaluating strategic options, such as a merger with a strong partner or a divestiture, for its construction chemicals business. BASF’s Chairman of the Board of Executive Directors commented: “We aim to reach agreement on a transaction during the course of 2019. We are currently preparing a structured process.”

Investments in organic growth in Asia

China is now already the key market in Asia and worldwide – both for BASF as well as for the entire chemical industry. BASF wants to grow faster than the global chemical market. “Therefore, we must participate in the growth in China, the world’s largest market for chemicals,” said Brudermüller. The Chairman of the Board of Executive Directors named a number of investment projects with which BASF wants to further strengthen its position in Asia and accelerate organic growth.

For example, at the end of October 2018, BASF signed an agreement with SINOPEC to expand their partnership at the Verbund site in Nanjing, China. The joint venture BASF-YPC will invest in a 50% stake to build another steam cracker with a capacity of 1 million metric tons of ethylene per year. SINOPEC Yangtzi Petrochemical will invest the other 50%. Furthermore, BASF and SINOPEC will jointly explore new business opportunities in the fast-growing Chinese market for battery materials.

India is another market where BASF wants to invest. The company recently signed a memorandum of understanding with Adani to investigate a major joint investment in the acrylics value chain. The designated site would be located at Mundra port in the Indian state of Gujarat. This would be BASF’s largest investment in India to date and its first CO2-neutral production facility.

A framework agreement signed in January 2019 with the government of Guangdong Province in southern China sets out further details of BASF’s plan to establish a new Verbund site in the city of Zhanjiang. More than 9 km2 of land are available to realize this project. In BASF’s view, the new site is ideal because it benefits from Zhanjiang’s natural resources, a deep-water port and excellent transportation links to Guangdong’s industrial centers.

Outlook for the year 2019

In the current year, BASF expects the global economy to grow by 2.8%, considerably slower than in 2018 (3.2%). In the European Union, the company anticipates weaker growth in both domestic demand and export demand from third countries. On the other hand, BASF presumes the United States will deliver solid growth, although the stimulus effect of the tax reform should be less pronounced than in 2018. Growth in China will likely continue to cool but remain high compared with the advanced economies. By contrast, the economic recovery in Brazil is expected to hold up.

The outlook is based on the following additional economic assumptions for the year 2019:

- Growth in global chemical production of 2.7% in 2019 (2018: +2.7%)

- Average oil price of $70 for a barrel of Brent blend crude

- An average exchange rate of $1.15 per euro

“We also expect growth in our customer industries to continue. For the automotive industry, we anticipate a slight recovery after lower production in the previous year,” said Brudermüller. BASF’s outlook also assumes that the trade conflicts between the United States and its trading partners will ease over the course of the year, and that Brexit will occur without wider economic repercussions.

“Even though the environment is challenging and characterized by a high level of uncertainty, we aim to grow profitably. We expect slight sales growth, mainly from higher sales volumes and portfolio effects. We want to slightly increase EBIT before special items. Furthermore, we anticipate return on capital employed (ROCE) will be slightly higher than the cost of capital percentage, but will decline slightly compared with the 2018 level,” said BASF’s Chairman of the Board of Executive Directors.

Brudermüller stressed that the first two quarters of 2019 will be relatively weak quarters: “Firstly, in the first half of 2018 we still benefited from high margins for isocyanates, so the basis of comparison is very high. Secondly, costs associated with the implementation of our strategy will have an impact on earnings, as will a higher number of scheduled plant turnarounds than in the previous year. The decisive factors for reaching our targets for 2019 are an improved business performance, solid customer demand as well as the first contributions from our strategic excellence program in the second half of the year. The structural changes we have initiated at BASF will also lead to noticeably higher negative special items in 2019.”

About BASF

At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility. The approximately 122,000 employees in the BASF Group work on contributing to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio is organized into six segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care and Agricultural Solutions. BASF generated sales of around €63 billion in 2018. BASF shares are traded on the stock exchanges in Frankfurt (BAS), London (BFA) and Zurich (BAS). Further information at www.basf.com.

On Tuesday 26, 2019, you can obtain further information from the internet at the following addresses:

| BASF Report 2018 (from 7:00 a.m. CET) | |

| basf.com/overview | (English) |

| basf.com/uebersicht | (German) |

| News Release (from 7:00 a.m. CET) | |

| basf.com/pressrelease | (English) |

| basf.com/pressemitteilungen | (German) |

| Live Webcast (from 10:30 a.m. CET) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

| Speech (from 10:30 a.m. CET) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

| Live Webcast – Conference Call for analysts and investors | |

| (from 2:00 p.m. CET) | |

| basf.com/conferencecall | (English) |

| basf.com/telefonkonferenz | (German) |

Note to Editors

You can download press photos and footage from the internet at the following links:

| Photos | |

| basf.com/pressphotos | (English) |

| basf.com/pressefotos | (German) |

| Current TV footage | |

| tvservice.basf.com/en | (English) |

| tvservice.basf.com | (German) |

| Current photos of the Annual Press Conference | |

| (on February 26, from 1:00 p.m. CET) | |

| basf.com//pressphoto-database/pc | (English) |

| basf.com/pressefoto-datenbank/pk | (German) |

| TV interview with Dr. Martin Brudermüller | |

| (on February 26, from 2:00 p.m. CET) | |

| basf.com/tv-interviews_en | (English) |

| basf.com/tv-interviews_de | (German) |

Receive the latest press releases from BASF via WhatsApp on your smartphone or tablet. Register for our news service at basf.com/whatsapp-news.

Forward-looking statements and forecasts

This release contains forward-looking statements. These statements are based on current estimates and projections of the Board of Executive Directors and currently available information. Forward-looking statements are not guarantees of the future developments and results outlined therein. These are dependent on a number of factors; they involve various risks and uncertainties; and they are based on assumptions that may not prove to be accurate. BASF does not assume any obligation to update the forward-looking statements contained in this release above and beyond the legal requirements.

P-19-141