Investors

Sustainable Steering of our Product Portfolio

Our society and customers have assumed great responsibility for sustainability in recent decades. We understand these expectations, seize opportunities for further development and minimize risks. We offer high-quality and sustainable solutions to promote a sustainable future without compromising profitability. Therefore, sustainability is central to BASF's corporate purpose: "We create chemistry for a sustainable future".

This ambition is linked to the following business drivers:

- Growing customer needs for sustainable solutions

- New regulations and standards of sustainability in value chains

- Increased demand for sustainable products due to changing framework conditions

To achieve these goals, we work closely with our customers to develop and promote economically viable and more sustainable solutions.

TripleS at a glance:

- We aim to increase the sales share of Sustainable-Future Solutions from 46.3% in 2024 (41.4% in 2023) to more than 50% by 2030

- The method is established at BASF, for more than 10 years

- Each product in its application can be assigned to one of 5 TripleS segments.

- More than 50,000 solutions are analyzed worldwide

- Semi-automated segmentation process enables high accuracy and updated segmentation

- Hundreds of experts are involved in approximately 70 business units

What do we do?

The definition of "Sustainable-Future Solutions" is based on the balance between the three dimensions of sustainability - environment, society and economy. We are committed to finding sustainable solutions by connecting creative minds while sourcing and producing responsibly.

With the update of the TripleS methodology in 2023, BASF is fostering developments in transformation topics linked to carbon management like Climate Change & Energy, Resource Efficiency and Circular Economy. Realization and adaptation of processes according to regulatory environmental authorities to improve overall assessment processes. We intend to early identify solutions which in future are likely to be affected by regulations and to avoid negative market perception

How do we do it?

We use a cross-sectional assessment setup by focusing on a two-step process

- Basic Sustainability Requirements: We identify material sustainability lacks acting as an early-warning indicator for our product portfolio. Each solution in its respective application and region is evaluated based on corporate minimum requirements and stakeholder specific criteria. This covers BASF’s Code of Conduct. Chemicals hazard and exposure across the life cycle, anticipated regulatory trends and sustainability ambitions along the value chain and risks for the company’s reputation

- Sustainability Value Contribution: After clearance of basic sustainability requirements, controversial business areas and contribution to one of the nine defined sustainability categories are checked. All relevant elements contributing to a sustainable future are subsequently analyzed and documented. Our Pioneer and Contributor products are the best choice for sustainable-future solutions in their application.

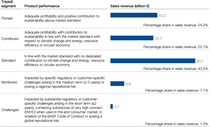

Share of sales revenue generated by each TripleS segment in the 2024 business year

Within the scope of the further development of our method, in 2023 we began to reassess the products in the relevant portfolio with regard to their applications and regional aspects. As a result, we categorize our product portfolio into five segments, taking sustainability-related aspects into account: Pioneer, Contributor, Standard, Monitored and Challenged. The reassessment was completed in 2024. We took regulatory changes into account if they had a material impact on our portfolio and therefore also on our segmentation. For detailed information see the BASF Report 2024.

The new KPI sales of Sustainable-Future Solutions summarizes the total sales of Pioneer and Contributor products. Products allocated to these segments make a positive sustainability contribution in the value chain. By 2030, more than 50% of BASF’s sales relevant to TripleS are to be attributable to Sustainable-Future Solutions. This new KPI sales of Sustainable-Future Solutions summarizes the total sales of Pioneer and Contributor products. Products allocated to these segments make a positive sustainability contribution in the value chain.

With the updated method TripleS, we are committed to deeper integrate transformative topics into the assessment process and increase transparency on BASF’s portfolio contributions to Carbon Management. These transformative topics include contributing to reduce and mitigate climate change and energy in the value chain, promoting circularity in or through our products and the reducing the use of resources during the production process or in the value chain.

In addition, upcoming legal requirements for the chemical industry are considered within the assessment. This covers, amongst others, European developments as introduced by the Chemical’s Strategy for Sustainability (CSS) as well as new international protocols related to, environment, health, and safety regulations. Regulatory developments, such as the revision of the Registration, Evaluation and Authorization of Chemicals (REACH) and the Toxic Substances Control Act (TSCA) in the United States, are directly integrated into the new method.

With this update we have integrated the TripleS evaluation even more deeply into the assessment of our R&D project pipeline also considering requirements formulated within the Safe and Sustainable-by-Design (SSbD) framework by the EU Commission. The assessment of R&D projects has also been achieved in 2024 and is part of the annual report 2024. Furthermore, TripleS continues to comply with the Portfolio Sustainability Assessment (PSA) method of the World Business Council for Sustainable Development which is applied broadly within the chemical industry.

These efforts and achievements by BASF on TripleS have been honored with the European Responsible Care® Award in 2023.