Investors

Well-balanced financing instruments

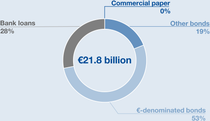

As of December 31, 2024

BASF’s liquidity position

- €3.0 billion cash and cash equivalents1

(as of December 31, 2024)

BASF’s financing facilities

- US$12.5 billion commercial paper program

(for short-term debt financing)

- €20 billion debt issuance program

(for long-term debt financing)

- €6 billion broadly syndicated backup line

(maturing in 2029)

- CNY 40 billion syndicated bank term loan

(maturing in 2038)

BASF’s rating target: single A rating

Current ratings2: S&P A-/A-2/outlook stable, Moody’s A3/P-2/outlook stable, Fitch A/F1/outlook stable

1 Including marketable securities 2 Fitch: November 1, 2024; S&P: December 2, 2024; Moody’s: April 17, 2024