Factbook

Financing

Our financing policy aims to ensure our solvency at all times, limiting the risks associated with financing and optimizing our cost of capital. We preferably meet our external financing needs on the international capital markets. BASF strives for a single A rating, which ensures unrestricted access to financial and capital markets. Our financing measures are aligned with our operational business planning as well as the company’s strategic direction and ensure the financial flexibility to take advantage of strategic options.

Financing policy

We have solid financing, both for ongoing business and for investment projects initiated or planned. Corporate bonds form the basis of our medium to long-term debt financing. These are issued in euros and other currencies with different maturities as part of our €20 billion debt issuance program. The goal is to create a balanced maturity profile, diversify our financing and optimize our debt capital financing conditions.

For short-term financing, we use BASF SE’s global commercial paper program, which has an issuing volume of up to $12.5 billion. As of December 31, 2024, no commercial paper was outstanding under this program. A firmly committed, syndicated credit line of €6 billion with a term until 2029 covers the repayment of outstanding commercial paper. It can also be used for general company purposes. In 2024, the term of this credit line was extended until 2029, and the credit line was not used at any point in 2024. In 2023, BASF Integrated Site (Guangdong) Co. Ltd., China, signed a syndicated bank term loan facility totaling 40 billion Chinese renminbi with a maturity of 15 years for the construction of the Verbund site in Zhanjiang. Of this amount, 17 billion Chinese renminbi (€2.1 billion) was utilized as of December 31, 2024. Our external financing is largely independent of short-term fluctuations in the credit markets.

BASF Group’s most important financial contracts contain no side agreements with regard to specific financial ratios (financial covenants) or compliance with a specific rating (rating trigger). To minimize risks and leverage internal optimization potential within the Group, we bundle the financing, financial investments and foreign currency hedging of BASF SE’s subsidiaries within the BASF Group where possible. Foreign currency risks are primarily hedged centrally using derivative financial instruments in the market.

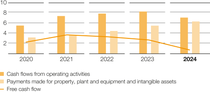

Cash flows from operating activities and free cash flow

In the 2024 business year, cash flows from operating activities stood at €6,946 million, down by €1,165 million on the prior-year figure. The decline was mainly caused by €1,434 million less cash released from net working capital. Cash inflows, both from the reduction in inventories and trade accounts receivable, were considerably lower in 2024 than in the previous year and totaled €264 million (previous year: €3,339 million). The increase in trade accounts payable led to cash released in the amount of €96 million, whereas cash in the amount of €1,544 million was tied up in the previous year.

Cash flows from investing activities totaled -€5,081 million in the business year 2024, after -€4,991 million in the previous year. Payments for intangible assets and property, plant and equipment increased by €803 million and were mainly incurred in connection with investments in the new Verbund site in China.

Cash flows from financing activities amounted to -€1,547 million, compared with -€2,905 million in 2023. The repayment and addition of financial and similar liabilities was reduced and their net change resulted in an improvement of €1,524 million in cash flows from financing activities. The dividend payment of €3,035 million to the shareholders of BASF SE remained unchanged compared with the previous year. By contrast, dividends paid to noncontrolling shareholders climbed by €190 million to €249 million.

Free cash flow, which remains after deducting payments made for property, plant and equipment and intangible assets from cash flows from operating activities, amounted to €748 million, compared with €2,715 million in 2023.

Cash flow

Billion €

Good credit ratings and solid financing

BASF enjoys good credit ratings, especially compared with competitors in the chemical industry. On April 8, 2025, Moody’s most recently confirmed its rating for BASF of A3/P-2/outlook stable. Standard & Poor’s confirmed its rating of A-/A-2/outlook stable on December 2, 2024. Fitch confirmed its rating of A/F1/outlook stable on November 1, 2024.

Ratings as of May 1, 2025

| Agency | Noncurrent financial indebtedness | Current financial indebtedness | Outlook |

| Moody’s | A3 | P-2 | stable |

| Standard & Poor’s | A- | A-2 | stable |

| Fitch | A | F1 | stable |